Unlock Affordable Private Health Insurance Plans for a Healthy Future with Major Nationwide PPO Networks

Gain access to top-notch healthcare providers and hospitals nationwide without breaking the bank. Get affordable private health insurance plans that offer comprehensive coverage for a brighter and healthier future.

Say goodbye to sleepless nights worrying about medical bills. Our affordable private health insurance options are designed to keep you healthy and your finances intact.

No more sacrificing your well-being due to budget constraints. With major PPO networks, you can access quality healthcare at a fraction of the cost.

It's time to take control of your health and your financial future. Say hello to affordable coverage that won't leave you feeling the pinch.

Unlock Affordable Private Health Insurance Plans for a Healthy Future with Major Nationwide PPO Networks

Gain access to top-notch healthcare providers and hospitals nationwide without breaking the bank. Get affordable private health insurance plans that offer comprehensive coverage for a brighter and healthier future.

Say goodbye to sleepless nights worrying about medical bills. Our affordable private health insurance options are designed to keep you healthy and your finances intact.

No more sacrificing your well-being due to budget constraints. With major PPO networks, you can access quality healthcare at a fraction of the cost.

It's time to take control of your health and your financial future. Say hello to affordable coverage that won't leave you feeling the pinch.

PPO Networks

Freedom and Flexibility to go to any doctor, any hospital nationwide. No referrals necessary.

Transparency

We'll present all your options clearly, in detail for every section through a virtual presentation.

Single Contact Person

You will be speaking directly with Kyle LaRose. You will NOT be bombarded with several phone calls.

PPO Networks

Freedom and Flexibility to go to any doctor, any hospital nationwide. No referrals necessary.

Transparency

We'll present all your options clearly, in detail for every section through a virtual presentation.

Single Contact Person

You will be speaking directly with Kyle LaRose. You will NOT be bombarded with several phone calls.

Guaranteed Renewable Plan Options for Secure and Worry-Free Coverage

Protect yourself and your loved ones with guaranteed renewable health insurance plans. Rest easy knowing your coverage remains secure, regardless of any changes in your health or circumstances.

Life is full of uncertainties, but your health insurance shouldn't be.

Don't let changes in your health or circumstances jeopardize your coverage. Our plans are guaranteed renewable, giving you continuous protection.

Enjoy the confidence of knowing that your health insurance will always be there for you and your loved ones.

Stay prepared for any unexpected medical expenses without the fear of losing your insurance coverage.

Guaranteed Renewable Plan Options for Secure and Worry-Free Coverage

Protect yourself and your loved ones with guaranteed renewable health insurance plans. Rest easy knowing your coverage remains secure, regardless of any changes in your health or circumstances.

Life is full of uncertainties, but your health insurance shouldn't be.

Don't let changes in your health or circumstances jeopardize your coverage. Our plans are guaranteed renewable, giving you continuous protection.

Enjoy the confidence of knowing that your health insurance will always be there for you and your loved ones.

Stay prepared for any unexpected medical expenses without the fear of losing your insurance coverage.

Low or No Deductible Options for Greater Affordability

Say goodbye to high deductibles that strain your finances. Choose from low or even no deductible options, making quality healthcare affordable and accessible.

Explore low or even no deductible options, making healthcare more affordable.

Save money upfront while still enjoying comprehensive coverage.

Take control of your budget and protect your health without breaking the bank.

Low or No Deductible Options for Greater Affordability

Say goodbye to high deductibles that strain your finances. Choose from low or even no deductible options, making quality healthcare affordable and accessible.

Explore low or even no deductible options, making healthcare more affordable.

Save money upfront while still enjoying comprehensive coverage.

Take control of your budget and protect your health without breaking the bank.

Tailored Private PPO Plans for Self-Employed Individuals, Families, and Small Businesses

Our PPO plans cater to your unique needs. Whether you're an individual, a growing family, or a small business, we have private PPO health insurance plans designed to meet your unique needs.

Embrace the benefits of tailored health insurance plans designed specifically for self-employed individuals.

Find the perfect plan that aligns with your lifestyle and provides the coverage you and your family require.

Small business owners can offer their employees comprehensive health insurance options without breaking the bank.

Enjoy the flexibility of tailored plans that cater to your specific requirements, ensuring your health and wellbeing are prioritized.

Tailored Private PPO Plans for Self-Employed Individuals, Families, and Small Businesses

Our PPO plans cater to your unique needs. Whether you're an individual, a growing family, or a small business, we have private PPO health insurance plans designed to meet your unique needs.

Embrace the benefits of tailored health insurance plans designed specifically for self-employed individuals.

Find the perfect plan that aligns with your lifestyle and provides the coverage you and your family require.

Small business owners can offer their employees comprehensive health insurance options without breaking the bank.

Enjoy the flexibility of tailored plans that cater to your specific requirements, ensuring your health and wellbeing are prioritized.

Getting Affordable Health Insurance:

Quick & Easy Process

1. Health Insurance Review

Free Comprehensive Health insurance review of all the available plans in your area. I will walk you through the public marketplace and private options to find a plan to fit your needs and budget.

2. Select your Plan

After reviewing all health insurance options, you will determine which plan suits your needs. After verifying all your families doctors are in network, we will submit an application in order to get your plan in place to protect you and your family.

3. Focus on what Matters Most!

Rest easy knowing you and your family have secured the necessary protection in case something were to happen. No more worries.

Getting Affordable Health Insurance:

Quick & Easy Process

1. Health Insurance Review

Free Comprehensive Health insurance review of all the available plans in your area. I will walk you through the public marketplace and private options to find a plan to fit your needs and budget.

2. Select your Plan

After reviewing all health insurance options, you will determine which plan suits your needs. After verifying all your families doctors are in network, we will submit an application in order to get your plan in place to protect you and your family.

3. Focus on what Matters Most!

Rest easy knowing you and your family have secured the necessary protection in case something were to happen. No more worries.

Private PPO Plans for Your Unique Needs: Traveling Healthcare Workers, Small Businesses, Real Estate Agents, Doctors, Truckers, and More

Find the perfect private PPO plan tailored to your profession and location.

Traveling healthcare workers can stay protected no matter where their new assignment is and avoid lapse in coverage when they want to travel.

Small business owners can provide their employees with quality health insurance options.

Real estate agents can focus on closing deals, knowing they have reliable coverage for themselves and their families.

Doctors can prioritize patient care, confident in the protection provided by our specialized health insurance plans.

Truckers can stay healthy on the road with coverage tailored to their profession, ensuring peace of mind throughout their journeys.

Private PPO Plans for Your Unique Needs: Traveling Healthcare Workers, Small Businesses, Real Estate Agents, Doctors, Truckers, and More

Find the perfect private PPO plan tailored to your profession and location.

Traveling healthcare workers can stay protected no matter where their new assignment is and avoid lapse in coverage when they want to travel.

Small business owners can provide their employees with quality health insurance options.

Real estate agents can focus on closing deals, knowing they have reliable coverage for themselves and their families.

Doctors can prioritize patient care, confident in the protection provided by our specialized health insurance plans.

Truckers can stay healthy on the road with coverage tailored to their profession, ensuring peace of mind throughout their journeys.

Comprehensive Health Insurance for Individuals, Families, and Small Businesses

Finding the right health insurance plan shouldn't be a daunting task. We offer comprehensive solutions for individuals, families, and small businesses to meet your unique needs.

Say goodbye to the confusion and hassle of searching for the perfect plan. Our comprehensive solutions simplify the process and ensure you have the coverage you need.

Don't settle for one-size-fits-all coverage. Our plans are tailored to fit the needs of individuals, families, and small businesses, providing peace of mind for everyone.

It's time to take the guesswork out of health insurance. Choose a plan that caters to your specific situation and protects what matters most.

Comprehensive Health Insurance for Individuals, Families, and Small Businesses

Finding the right health insurance plan shouldn't be a daunting task. We offer comprehensive solutions for individuals, families, and small businesses to meet your unique needs.

Say goodbye to the confusion and hassle of searching for the perfect plan. Our comprehensive solutions simplify the process and ensure you have the coverage you need.

Don't settle for one-size-fits-all coverage. Our plans are tailored to fit the needs of individuals, families, and small businesses, providing peace of mind for everyone.

It's time to take the guesswork out of health insurance. Choose a plan that caters to your specific situation and protects what matters most.

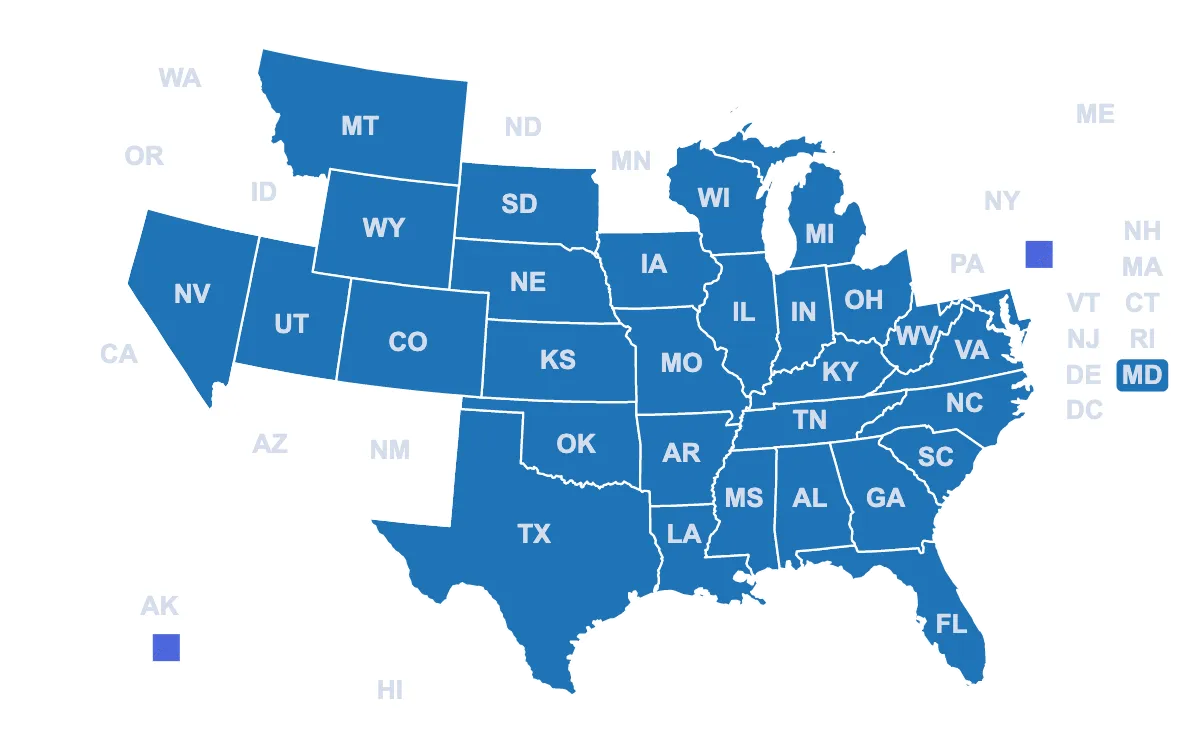

Find Affordable Private Health Insurance Near You!

Seeking affordable private health insurance doesn't mean compromising on quality or convenience. Discover plans near you that offer both affordability and accessibility.

Say goodbye to endless online searches for "health insurance plans near me."Find the perfect health insurance plan tailored to your needs, whether you reside in Florida, Georgia, Nevada, or any other state in blue.

Say goodbye to the hassle of searching for "health insurance plans near me" and trust our expertise in finding the right fit for you.

Begin your journey towards a healthier future with a simple quote request and discover the benefits of comprehensive health insurance.

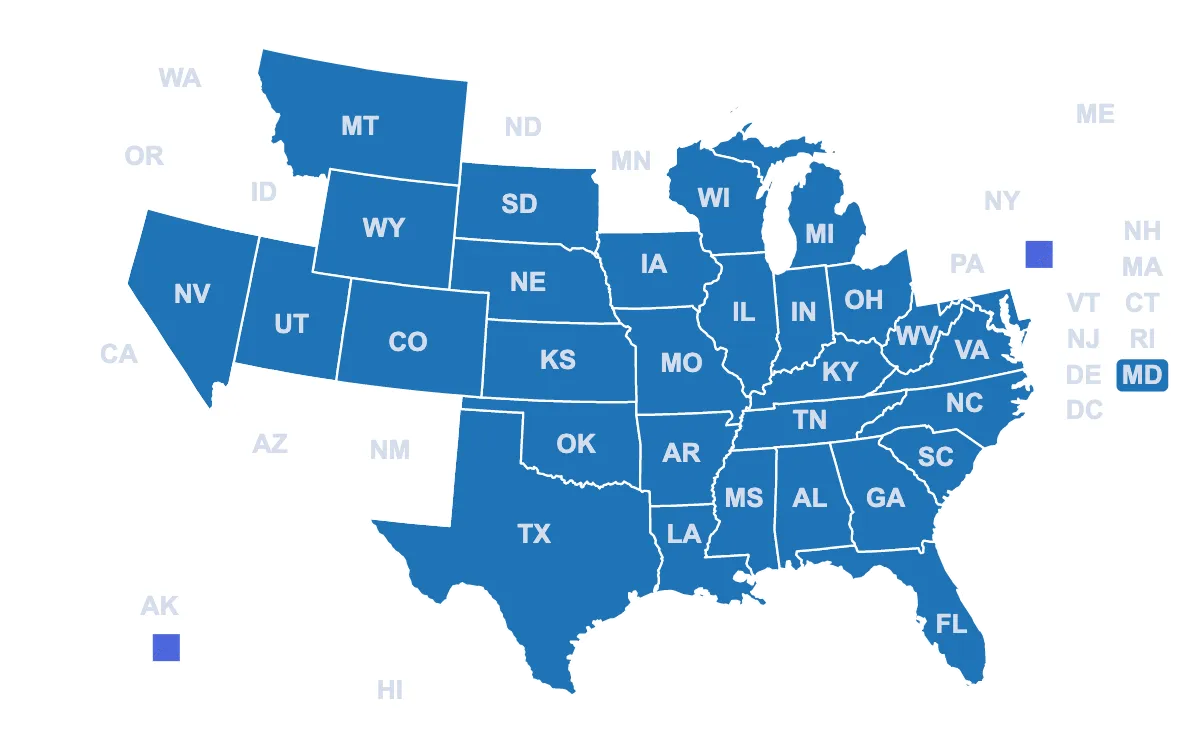

Find Affordable Private Health Insurance Near You!

Seeking affordable private health insurance doesn't mean compromising on quality or convenience. Discover plans near you that offer both affordability and accessibility.

Say goodbye to endless online searches for "health insurance plans near me."Find the perfect health insurance plan tailored to your needs, whether you reside in Florida, Georgia, Nevada, or any other state in blue.

Say goodbye to the hassle of searching for "health insurance plans near me" and trust our expertise in finding the right fit for you.

Begin your journey towards a healthier future with a simple quote request and discover the benefits of comprehensive health insurance.

About Health Insurance by LaRose

My name is Kyle LaRose and I am a passionate Licensed Health Advisor, offering affordable health care plans for entrepreneurs, self employed individuals and families, and small business owners with the best plans on the market.

Although I’m a graduate of Law School and received my Juris Doctorate of Law, my passion is in health care–– helping people find the most cost-effective health insurance coverage that fits their needs.

Growing up, I knew I always wanted to be of service, making a difference in people’s lives. Back then, I thought being an attorney would pave that path for me, but in 2018 those plans took a detour. After finding out my fiancé was pregnant with our miracle baby, I was facing the choice of either taking the bar exam or being there when my child was born. I chose the latter and haven’t looked back once. Even with all the time, effort, and 7 1/2 years of schooling to become a lawyer, being a present dad meant so much more to me.

That said, once I made my choice to pursue another career, I thought it’d be challenging, especially starting from scratch. But, it happened pretty quickly with the inspiration of becoming a soon-to-be father. I, unexpectedly, found myself drawn to the Health Insurance Industry, becoming a Licensed Health Advisor to help individuals, families, and entrepreneurs with their insurance plans. And after working with my first handful of clients, I knew I was in the right place, loving my new career and excited about my future.

Client Testimonials

Contact Us and See If You Qualify!

Call us today to learn about your health insurance options

We'll learn and get to know your specific needs for health insurance.

We'll present all your options clearly, in detail for every section.

Together, we'll take a tailor-made coverage approach, if applicable.

We'll submit your application once complete.

Frequently Asked Questions:

How much are your services?

Absolutely free. We pride our selves on educating individuals and businesses on their health insurance options.

What is Cobra and should I take the coverage?

COBRA stands for the Consolidated Omnibus Budget Reconciliation Act, a federal law in the United States that allows individuals to continue their employer-sponsored health insurance coverage for a limited period of time after experiencing certain qualifying events that would result in the loss of coverage.

When someone should accept COBRA depends on their specific circumstances. Here are some key points to consider:

Qualifying Events: COBRA is typically offered when an individual experiences a qualifying event such as job loss, reduction in work hours, or certain life events like divorce or the death of the covered employee.

Coverage Continuation: COBRA allows individuals to continue the same group health insurance coverage they had while employed. This can be important for individuals who have ongoing medical needs or prefer to keep their current network of doctors and providers.

Duration of Coverage: COBRA coverage is generally limited to a maximum of 18 months for job loss or reduction in work hours. Other qualifying events, such as divorce or the death of the covered employee, may allow for extended coverage periods of up to 36 months.

Cost Considerations: It's crucial to note that individuals who elect COBRA coverage are responsible for paying the full premium, including the portion that was previously covered by the employer. This can make COBRA coverage more expensive compared to employer-sponsored coverage, as the employer may no longer contribute to the premium.

Marketplace Options: Before accepting COBRA, individuals should explore other options available to them, such as purchasing coverage through the Health Insurance Marketplace. Depending on their income and eligibility, they may qualify for premium subsidies or other financial assistance, potentially making marketplace plans more affordable than COBRA.

Enrollment Deadline: If eligible for COBRA, individuals typically have 60 days to elect coverage from the date of receiving the COBRA notice. It's important to carefully review the notice and make a timely decision to avoid losing the opportunity for coverage continuation.

Private PPO Options: Before accepting COBRA, see if you qualify for a private PPO plan that rewards you with affordable comprehensive coverage based on being healthy.

In summary, individuals should consider accepting COBRA if they have ongoing medical needs, want to maintain their current network of providers, and do not have immediate access to alternative health insurance coverage. However, it's essential to carefully assess the cost implications and compare COBRA options with other available options to make an informed decision that aligns with their healthcare and financial needs.

© 2023 HEALTH INSURANCE BY LAROSE. All Rights Reserved.